Gratuity Calculator UAE 2025: Fast and Precise Results

Gratuity Calculator UAE

Gratuity Calculator UAE

A gratuity in Dubai and UAE is an end-of-service benefit paid to employees when they leave a job based on the length of their service. It is calculated according to UAE labor law and typically depends on the employee’s basic salary and years of employment.

Calculating gratuity manually can be complex and prone to errors. It requires understanding UAE labor laws, factoring in variables like your length of service, salary, and termination type, and applying the correct formulas. Missing even a small detail can lead to incorrect results.

How Do You Use This UAE Gratuity Calculator?

Here is an easy step-by-step guide for your gratuity computation:

You don’t need formulas or complex calculations with our gratuity calculator—it handles everything for you.

This tool is useful if you’ve worked for more than one year, your termination is legal, and you have a good work record. Whether you’re in Abu Dhabi, Dubai, or anywhere in the UAE, it ensures you understand your end-of-service benefits—hassle-free.

Disclaimer

Our gratuity calculator is a helpful tool, not a legal one. It estimates your gratuity based on UAE labor laws and the details you provide. Factors like compensation during your tenure, employment agreement terms, or incomplete information can affect the results.

The calculator is not liable for errors and should not be used for legal purposes. For legal matters, we recommend consulting a lawyer.

Crucial Factors for Gratuity Calculation in UAE

Article 132 of the new UAE Labour Law 2024 explains the end-of-service benefits for full-time employees. If you’ve completed at least one year of continuous service, you’re entitled to a gratuity based on your last basic wage.

Eligibility Criteria:

Your Gratuity Depends on your Contract type

Your contract type also impacts your gratuity calculations.

Limited Contract Type

According to Article 38, a limited contract may not exceed 4 years in duration. It can, however, be renewed or extended by mutual agreement between the employer and the employee. If renewed, the new term is considered an extension of the original period for calculating the employee’s total service duration.

Forfeiture of Gratuity:

Renewals and Gratuity:

Unlimited Contract Type

An unlimited contract (indefinite term contract) is one without a specific duration, or where no written agreement specifies an end date (Article 39). It also applies if a limited contract continues without written renewal after its expiry, or if the work has no specific duration or is recurrent by nature (Article 39). Either party may terminate it with at least 30 days’ written notice (Article 117).

Employees under an unlimited contract must complete at least one year of continuous service to qualify for gratuity (Article 132).

In case of Termination:

By the Employer Without Cause:

Dismissal for Valid Reasons (Article 120):

In case of Resignation:

Additional Terms and Conditions for Gratuity according to UAE Labor Law:

Gratuity Calculation Basis:

Gratuity is calculated based on the basic wage only and excludes:

Severance Adjustments:

Employers can deduct amounts owed by the employee (e.g., loans, advances) from the gratuity payment (Article 135).

Legal Heirs:

In case of the worker’s death, gratuity is paid to their legal heirs (Article 136).

Continuous Service Requirement:

Breaks in service may disqualify an employee from gratuity unless these breaks are expressly approved by the employer (Article 132).

UAE gratuity calculation formula

Our UAE Gratuity Calculator gives you a quick and accurate estimate of your gratuity. For those interested in the manual calculation process, we’ve summarized the key guidelines and formulas below.

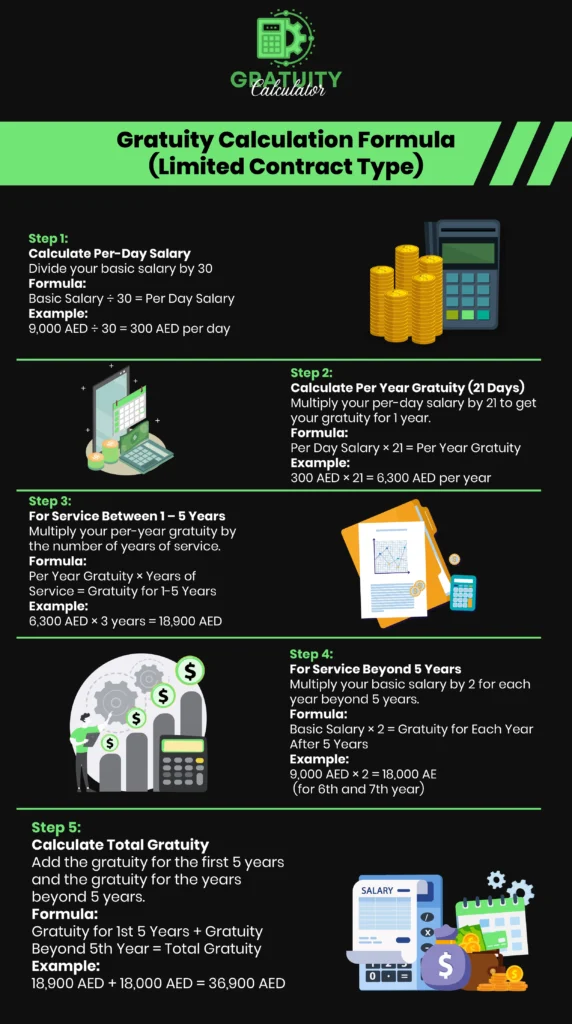

How To Calculate Gratuity In UAE For Limited Contract

If you are on a limited contract, you can calculate your estimated gratuity after completing your service period by this formula.

Basic Salary/30 = Per day salary

For instance, if your basic salary is 9,000 Dirhams,

9,000/30= Dh 300

Per day salary * 21= Per year Gratuity

300*21= Dh 6,300

Per year gratuity * Service years = Gratuity

For 3 year contract,

6300*3= Dh 18,900

For instance, if your service tenure is 7 years,

9000*2= Dh 18,000.

It will be your gratuity for the 6th and 7th year.

Gratuity of first 5 years + Gratuity of 5th year onwards = Total Gratuity

18,900 + 18,000= Dh 36,900

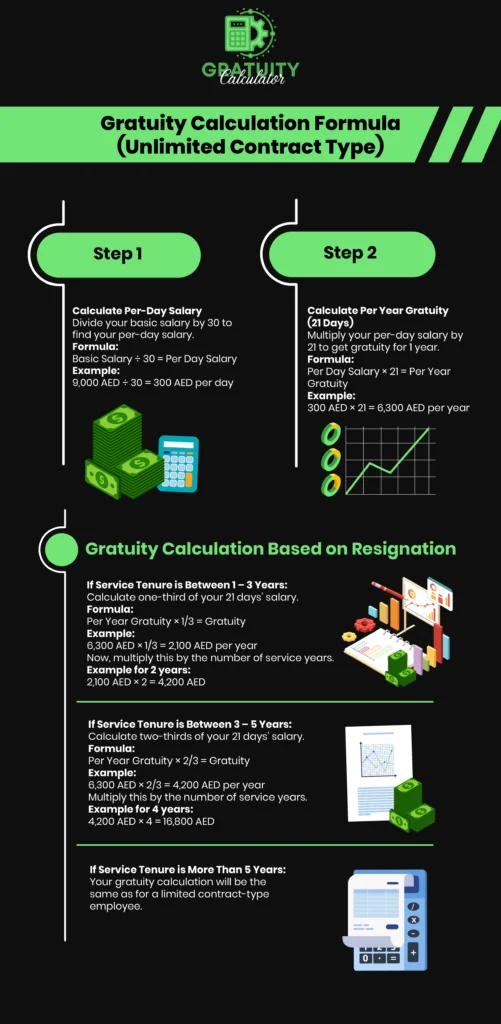

How To Calculate Gratuity In UAE For Unlimited Contract

Your gratuity calculations will remain the same in case of termination in unlimited contract type. But if you have resigned from your job, add these steps to the gratuity calculation.

For Dh 9,000 basic salary,

9,000/30= Dh 300

300*21= Dh 6,300

6300* 1/3 = Dh 2100

It is your per-year gratuity.

For instance, for 2 years

2100*2 = Dh 4200

It will be your gratuity amount.

6300* 2/3 = Dh 4,200

It is your per-year gratuity.

For instance, for 4 years:

4200*4 = Dh 16,800

It will be your gratuity amount.

Common Mistakes to avoid while Using end of service calculator dubai

# 01 Interpretation of Salary

Mistake: I will get my gratuity on my total salary.

Clarification: Your gratuity is according to your basic salary. It excludes all allowances from your salary, like housing allowance, fuel, medical compensation, etc.

# 02 Calculation of Service Duration

Mistake: I will get my gratuity on the approximated duration of service.

Clarification: Your gratuity should be calculated based on the exact duration of your service tenure. There is no round-off thing when it comes to gratuity calculation.

# 03 Understanding Contract Type

Mistake: I will get the same gratuity per year of service regardless of my contract type.

Clarification: According to UAE Labor Laws, formulas of gratuity calculations are different for limited and unlimited contract-type jobs.To better understand the differences, see Limited vs Unlimited Contract UAE.

# 04 End of Service Benefits:

Mistake: Gratuity is the other name for end-of-service benefits.

Clarification: Your gratuity is just one component of your end-of-service benefit. There might be other benefits as well based on your job agreement.

# 05 Overgeneralization

Mistake: Gratuity is the same for everyone regardless of when they leave the job.

Clarification: The gratuity amount varies with the tenure of your service. You are not eligible for gratuity if your service period is less than one year.

Also See: domestic worker gratuity

Tips to Increase Gratuity

Our Gratuity Calculator UAE is a valuable tool for calculating your end-of-service benefits, helping you plan effectively for the end of your service. While it provides you helpful estimates, it may not account for specific factors that could influence the final calculation.

For the most accurate results, it’s a good idea to use tools like the Gratuity Calculator as a guide and consult a professional to ensure you maximize your benefits before making any final decisions.